BRAZIL OVERTIME

Longer-term Impacts of COVID-19

In response to a lack of opportunities in the formal sector In Brazil (and across the globe), low- and middle-income workers gravitated towards the digital gig economy for supplemental income and more flexible work. Gig platforms that developed during the past 10 years created new ways for these informal workers to earn a living as well as new opportunities for fintechs and others to better serve these people. COVID-19 and the accompanying economic dislocation triggered a significant shift in the lives of these essential workers. They were especially hard hit.

To better understand the longer-term impact of the COVID-19 pandemic, we conducted the Brazil Overtime 2020 research report from May–December, 2020. We surveyed more than 1,800 gig workers (MEIs) to learn first hand the financial impact of the pandemic, how livelihoods are changing, the coping mechanisms being employed and how fintech entrepreneurs can better serve this population. The results are sobering. We are now more committed than ever to partner with fintech entrepreneurs and others who seek to establish trust and provide long-term solutions for this vulnerable population.

Read the full Brazil Overtime 2020 report below. The Brazil Spotlight report focuses on the initial May 2020 research and can be used in comparison with the other country-specific Digital Hustle Spotlight reports.

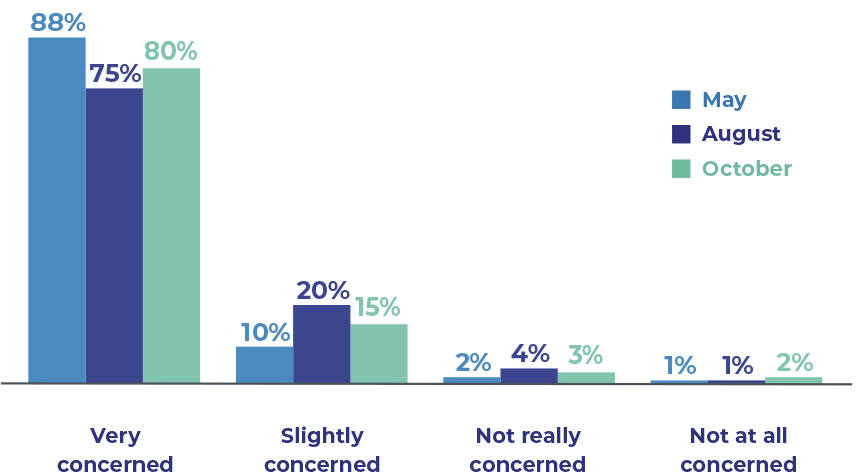

Level of Concern

Concern about COVID-19 consistently remained high from May–December, 2020.

I can’t sleep at night thinking about my bills, worried about my son and everyone’s health.”

– Delivery driver

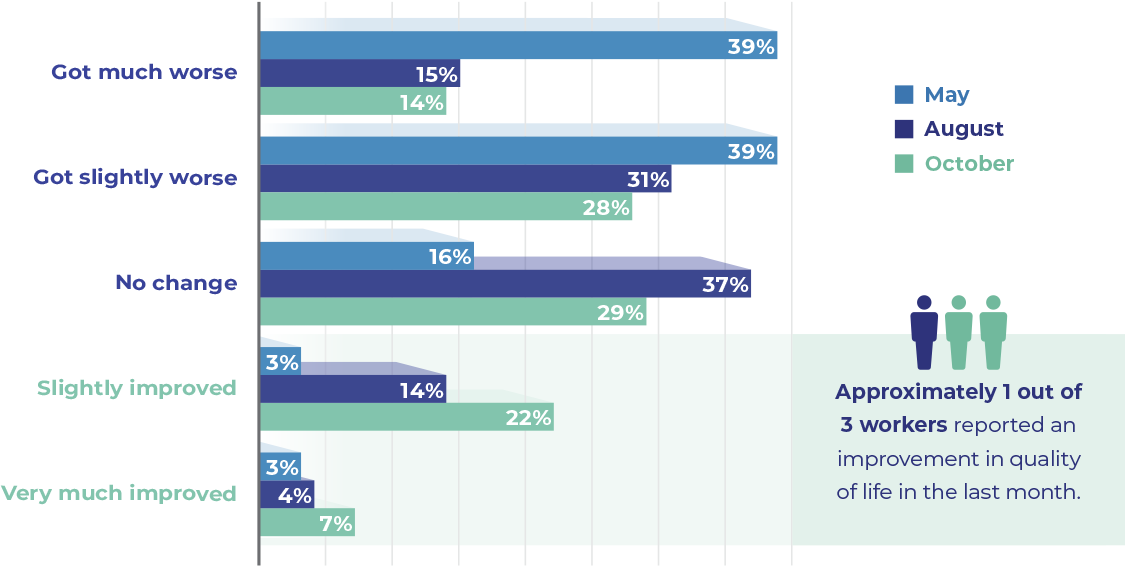

Quality of Life

While quality of life continues to decrease for around 40%, there is a positive trend in those reporting improvements in quality of life.

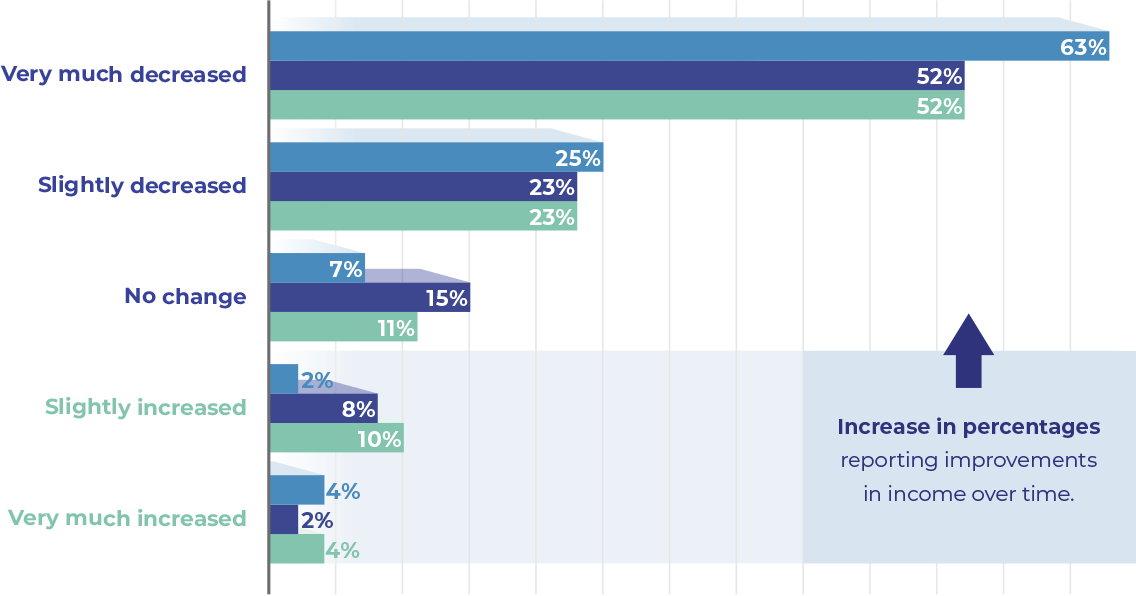

Change in Income

Respondents have continued to see month-over-month reductions in income throughout the pandemic.

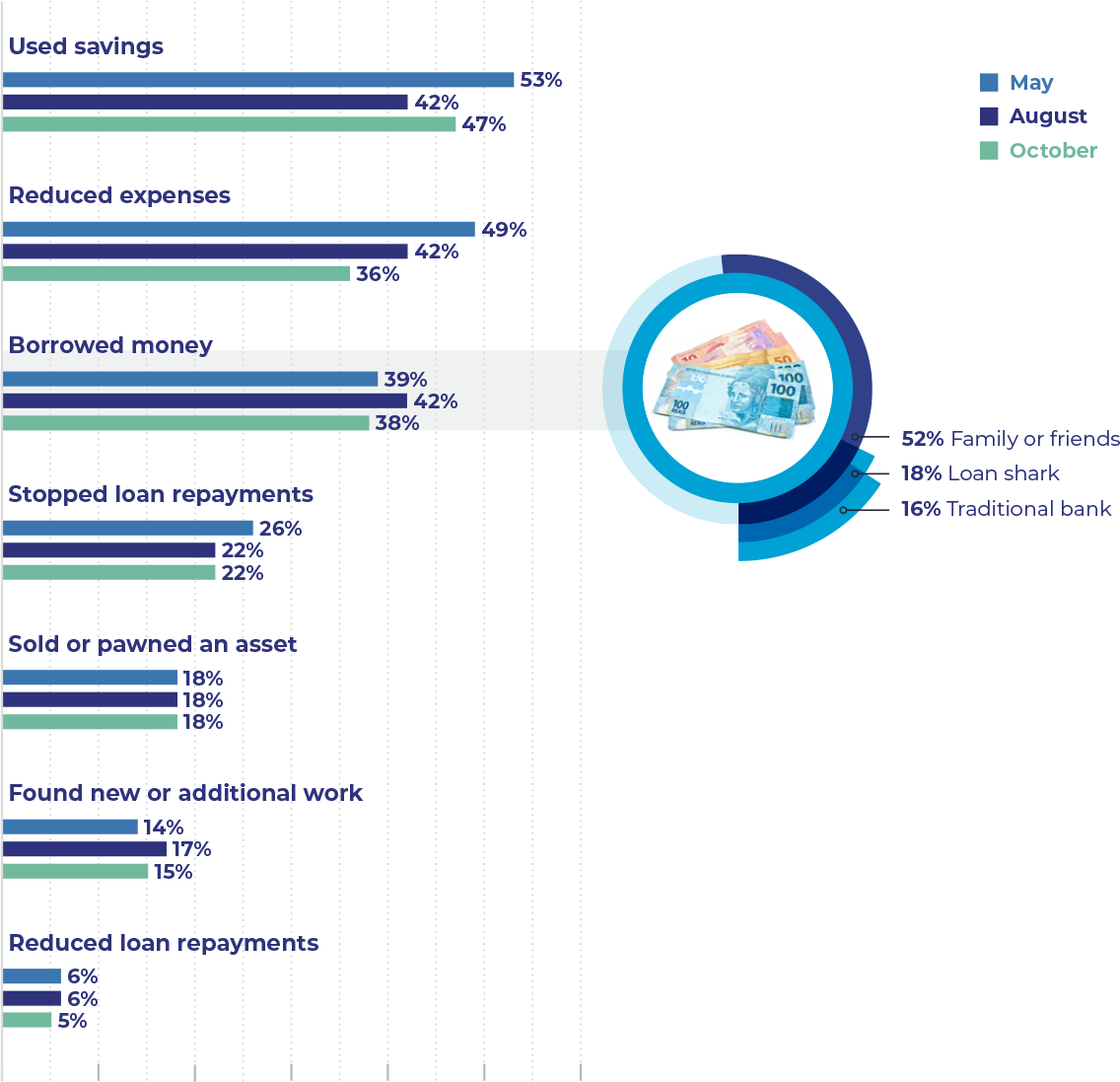

Coping Mechanisms

Gig workers reported consistency in the coping mechanisms they turned to during the pandemic and only ~1 in 5 are borrowing from formal sources.

My financial situation got worse [because of COVID-19], since I spent all my savings to pay my debts.”

– E-hailing driver

Concerns and Goals

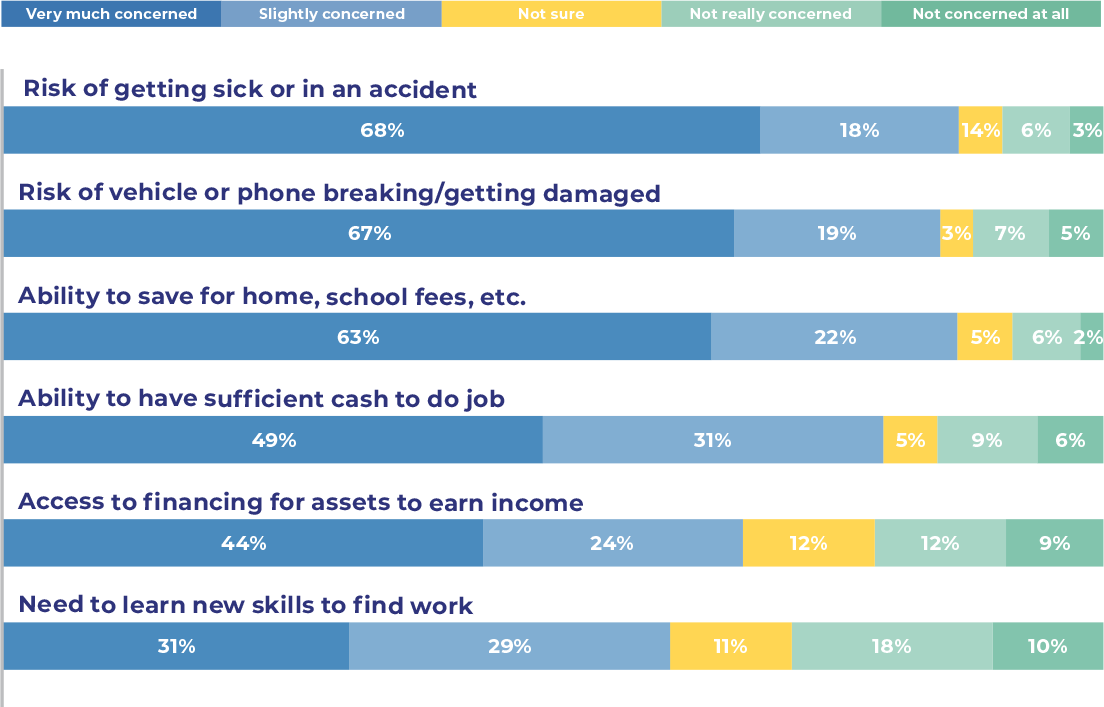

Top Concerns Related to Work

Gig workers are most concerned about factors that would stop them being able to work.

I’m out of work: I fell off a motorcycle and broke my collar bone. I’m at home without a dollar in my pocket.”

– Delivery driver

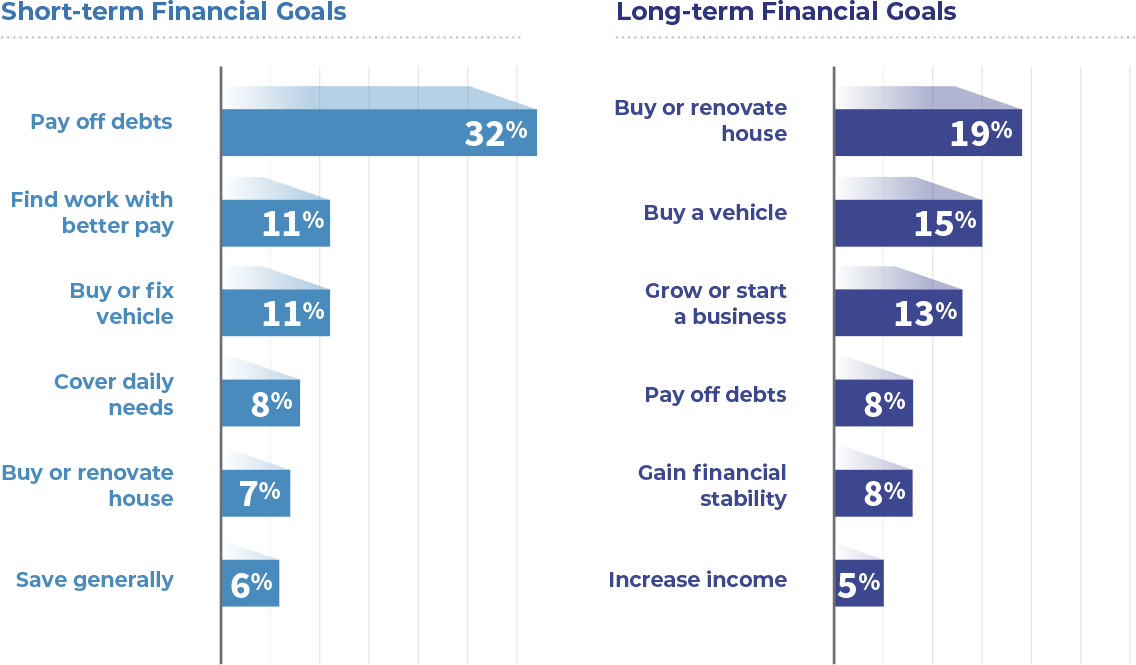

Financial Goals

We asked customers about their financial goals for this year and the following 2–4 years. This year, gig workers are most keen to pay off their debts. In the next few years, buying a house or vehicle are top-of-mind.

Innovative Solutions

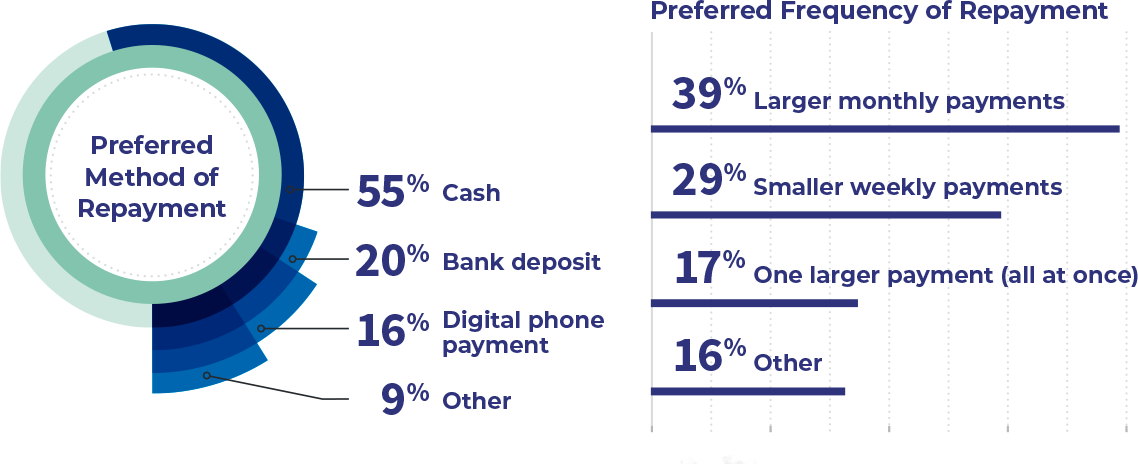

Credit

With approximately 40% of respondents reporting that they are borrowing as a way to cope, respondents were also asked their preferred frequency and method to repay their debts.

I can barely plan a week ahead, let alone a month ahead. Sometimes it feels like I am living day by day. I need more control.”

– Delivery driver

Insurance

81% of respondents reported they were interested in purchasing insurance, especially health insurance. Although the majority of gig workers are interested in insurance, they mainly spoke of how they would be able to pay for things. For those not interested, they spoke of not wanting to take on debt. This suggests that there is a potential misunderstanding of how insurance might work.

Most Demanded Types of Insurance

When asked to rank types of insurance by interest, health and vehicle were most commonly ranked in the top 2 types of insurance that gig workers were most interested in. Income insurance drew a barbell response as a large portion ranked it as either their first or last option. This could suggest that there is less understanding of the product.

We conducted this research because we believe that services offered by fintechs and other financial providers can help advance economic opportunity and improve gig workers’ financial lives around the world. Digital financial services play an important role in helping people find new sources of income, manage their day-to-day cash flows, protect against risk, gain access to capital, and save for the future. We hope that Brazil Overtime and the entire Digital Hustle Series provides some early insights to help inform how digital platforms and financial service providers can best serve these needs.

BRAZIL SPOTLIGHT

COVID-19 Impact on Gig Workers in Brazil

In Brazil and across the globe, low- and middle-income workers have been gravitating toward the digital gig economy for supplemental income, more flexible work, and in response to a lack of opportunities in the formal sector. Over the past 10 years, gig platforms have created new ways for informal workers to earn a living and new ways for fintechs and others to serve these people.

The COVID-19 pandemic and the accompanying economic dislocation have triggered a significant shift in the lives of these gig workers, as this population have been particularly hard hit.

As a global fintech investor committed to financial wellbeing, Flourish Ventures seeks to better understand the financial impact of the pandemic on Brazilian gig workers, how their livelihoods are changing, and how fintechs can better serve this population. With that aim, Flourish undertook a longitudinal study of over 500 Brazilian gig workers in partnership with MEI Fácil and 60 Decibels.

Impact on Livelihoods & Well-being

Brazilian gig workers have experienced sudden and severe financial impacts since the pandemic emerged.

Monthly Income Before & After the COVID-19 Lockdown

My life became really difficult when all the businesses were closed. It has been hard to find side jobs to help me out.”

– Delivery driver, Brazil

Financial Resilience

Gig workers are living on the edge. Three months into the pandemic, half of gig workers reported that they could not cover expenses for a week without borrowing money if they lost their main source of income.

All my bills are overdue and I’m doing small jobs just so I can eat.”

– Delivery worker, Brazil

If you lost your main source of income, how long could you continue to cover living expenses without borrowing money?

I lost my work vehicle since I had to return my car to pay off my debt to the bank.”

– E-hailing driver, Brazil

Some Gig Workers Impacted More Than Others

E-hailing Reporting Larger Loss in Income

While e-hailing services were hit the hardest by the national lockdown — 75% suffered a large decrease in income — half of delivery workers also reported a large decline in demand for their services.

I work as a motorcycle taxi, and people are afraid of getting the virus, so they don’t get a motorcycle taxi anymore.”

– E-hailing driver, Brazil

Women Are Hit Harder

E-hailing and delivery work is widely dominated by men. Our female sample size is too small to draw broad conclusions, but across both gig workers and offline workers, women were particularly hard hit — 77% of female primary household earners made <$200 this past month. We also found that across offline female workers who are seeking new sources of income, 10% are moving into app-based delivery.

Sales decreased and I am unable to buy stock to manufacture. Now I work just enough in delivery for food and some bills.”

– Female beautician, Brazil

Coping Mechanisms

Despite a widespread loss of income, gig workers are finding ways to cope. Over half of gig workers made spending cuts, often by reducing food and household goods purchases. Half dipped into savings and nearly half borrowed money. Half are seeking new sources of income — with a third moving into delivery.

We cut our food consumption. Now we only have one hot meal a day. We also take cold showers when the weather is warm to save electricity.”

– E-hailing driver, Brazil

Looking Forward

Gig workers have remained digitally connected through this current crisis, and we expect even greater adoption of online platforms, digital payments, and other fintech tools going forward. These technologies have the potential to help gig workers adapt to new opportunities and build financial resilience in the face of the COVID-19 pandemic and beyond.

In the coming months, this Digital Hustle Research Series will track how gig work is evolving in Brazil and around the globe and analyze how gig workers’ financial needs are changing.

We will dive deeper into gig workers’ financial lives, concerns, and aspirations, and we will explore the implications for fintechs and others who seek to provide long term solutions.

Survey Methodology

Flourish Ventures partnered with research firm 60 Decibels and microentrepreneur services provider MEI Fácil to conduct an online survey of approximately 560 gig workers from May 19–29, 2020. Of these respondents, there were approximately 350 e-hailing drivers, 150 delivery workers, and 60 workers on other types of gig platforms. Survey respondents were compensated for their participation. Underlying data can be viewed here.

Authors: Arjuna Costa, Jenny Johnston, Stella Klemperer